Common Response To Home Mortgage Questions

Content written by-Silva SanchezGoing through the home mortgage process can be tricky and fraught with a lot of obstacles. If you are looking for a home and don't know where to begin, then keep reading because you will need to know how to prepare yourself to get approved for a mortgage. Read on for valuable home mortgage tips.

Having the correct documentation is important before applying for a home mortgage. Before speaking to a lender, you'll want to have bank statements, income tax returns and W-2s, and at least your last two paycheck stubs. If you can, prepare these documents in electronic format for easy and quick transmission to the lender.

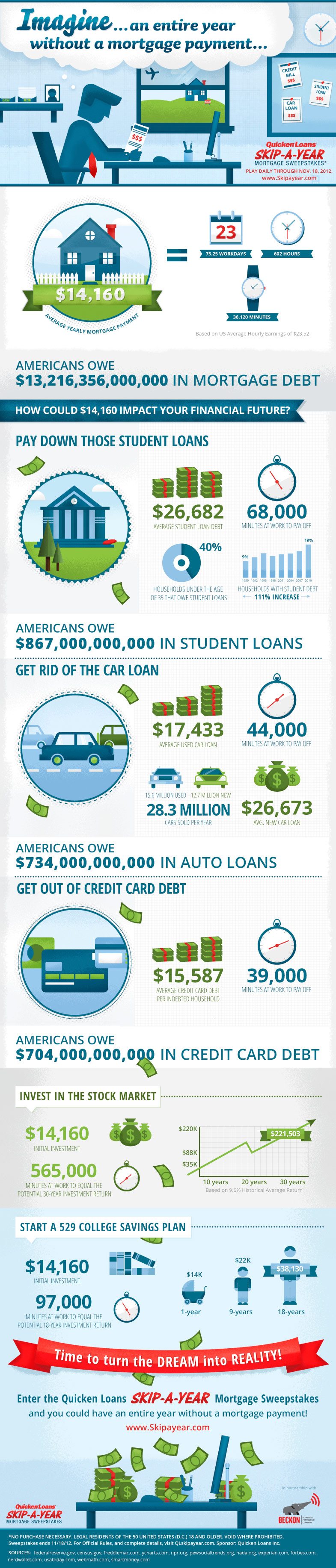

Before applying for a mortgage, pay down your debts. Lenders use a debt to income ratio to verify that you are able to afford a mortgage. A general rule of thumb is 36 percent of your gross income should be available to pay all of your monthly expenses, including your mortgage payment.

Getting the right mortgage for your needs is not just a matter of comparing mortgage interest rates. When looking at offers from different lending institutions you must also consider fees, points and closing costs. Compare all of these factors from at least three different lenders before you decide which mortgage is best for you.

Get mortgage loan estimates from at least three different mortgage lenders and three different banks. By shopping around, you may get a lower interest rate, pay fewer points and save money on closing costs. It's almost always preferable to get a fixed interest rate. With variable rates, you may not know from month to month what your mortgage payment will be.

Know what the going interest rate is. This will help you know when to lock in an interest rate. Many mortgage companies offer to lock you into a particular interest rate for a period of 30 to 60 days. If the interest rates increase, you are protected. If they decline you can opt for the new interest rate.

Consider a mortgage broker instead of a bank, especially if you have less than perfect credit. Unlike banks, mortgage brokers have a variety of sources in which to get your loan approved. Additionally, many times mortgage brokers can get you a better interest rate than you can receive from a traditional bank.

Know current interest rates. Getting a loan without depending on interest rates is possible, but it can determine the amount you pay. Figure out what the rates are and know what they're going to cost you monthly and overall when all is said and done. Do not sign your mortgage loan documents until you understand exactly what your interest expense will be.

Some financial institutions allow you to make extra payments during the course of the mortgage to reduce the total amount of interest paid. This can also be set up by the mortgage holder on a biweekly payment plan. Since there is often a charge for this service, just make an extra payment each year to gain the same advantage.

If you are able to pay more for your monthly payments, it is a good idea to get a shorter-term loan. Most lenders will give you a lower rate if you opt to pay your mortgage over 20 years instead of 30 years. Borrowers who get shorter term loans (such as 15 or 20 years terms) are considered less risky than those with longer term loans, resulting in lower interest rates.

Pay off or lower the amount owed on your credit cards before applying for a home mortgage. Although your credit card balances do not have to be zero, you should have no more than 50 percent of the available credit charged on each credit card. This shows lenders that you are a wise credit user.

Many lenders now require a home to be inspected before the loan is approved. Although this costs a small amount of money, it can save you thousands in unknown expenses. If the home inspector finds problems with the home, you have the opportunity to either negate the contract or to renegotiate the sales price.

Mortgage rates change frequently, so familiarize yourself with the current rates. You will also want to know what the mortgage rates have been in the recent past. If mortgage rates are rising, you may want to get a loan now rather than later. If the rates are falling, you may decide to wait another month or so before getting your loan.

Ask your lender in advance what documentation they need before you meet with them. This is usually going to include tax returns, income statements and W2s, although more might be needed. The more time you have to get it all together is the less likely you'll be unprepared at the actual meeting time.

Before you apply for a mortgage, know what you can realistically afford in terms of monthly payments. Don't assume any future rises in income; instead focus on what you can afford now. Also factor in homeowner's insurance and any neighborhood association fees that might be applicable to your budget.

A shorter loan term is often considered superior to a longer term, even if your monthly payments are higher. These short-term loans have lower interest rates and monthly payments that are slightly higher in exchange for the shorter loan period. This can save you thousands over the term of your mortgage.

You can save money on a mortgage by going with a lender who offers to finance with no closing costs. Closing Go At this site are a significant part of a mortgage. To make up for that lost money, however, the lenders will make up it in some other way. Usually with a slightly higher interest rate.

If you come into some money for any reason, do not go on a spending spree. The best investment you can make is in your home. Use unexpected cash to pay down your mortgage quicker. Recommended Web-site have to pay less interest. It also lets you become the true homeowner sooner.

Finding the right home mortgage for your situation can sometimes be a confusing process. Many people are not familiar with how to begin the process of seeking a home mortgage. Thankfully the article you just read was packed full of quality tips that should have left you feeling like an expert on the subject of home mortgage.